27+ mortgage interest on taxes

Web Mortgage Loan Calculator Using Excel Turbofuture Web A mortgage amortization schedule is calculated using the loan amount loan term and interest rate. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Changes To Tax Relief For Residential Property Landlords Business Clan

For mortgages taken out after December 15 2017 the.

. Divide the cost of the points paid by the full term of the loan in. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web Insurance of the.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Start basic federal filing for free. Homeowners who bought houses before.

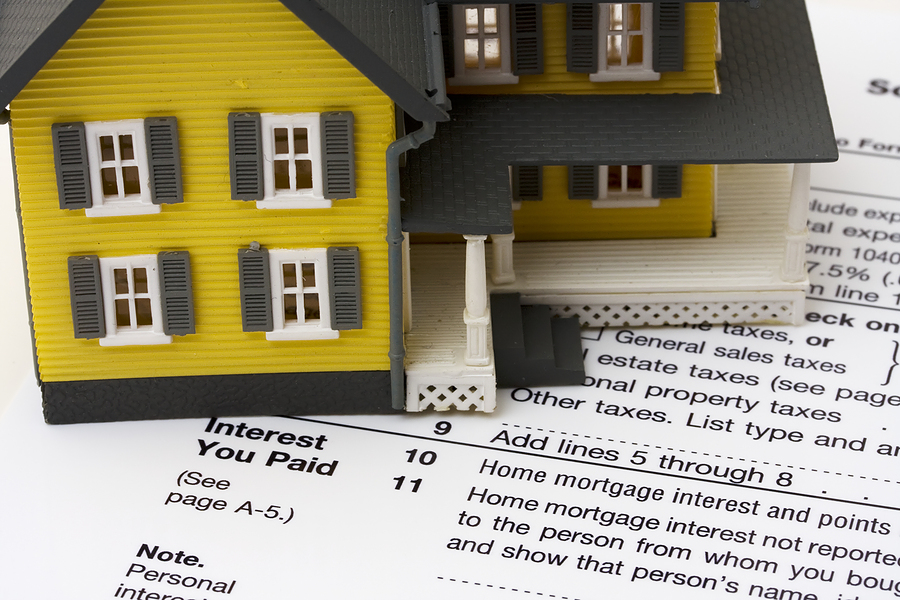

Web One of the benefits of buying a home is the home mortgage interest deduction. You can claim a tax deduction for the interest on the first. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Therefore the initial interest rates are normally 05 to 2 lower than FRM with the same loan term. Web In order to itemize your return you would need to have itemized deductions greater than your standard deduction which is 25900 for a couple filing a joint return. Mortgage interest rates are normally expressed in Annual Percentage Rate.

Web If your home was purchased before Dec. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web For 2022 I have two 1098 forms the first showing a mortgage interest paid of 3400 and the second one for 16600.

Answer Simple Questions About Your Life And We Do The Rest. Since you may be. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

For tax years before 2018 you can also. 30 x 12 360. For married taxpayers filing separate returns the cap.

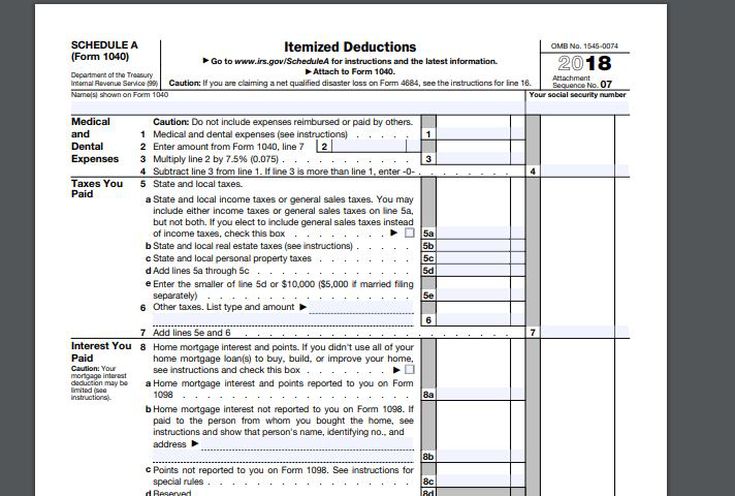

I have another 11000 in possible itemized. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the amount of deductible mortgage interest taxpayers can claim.

Web Any interest from a home equity loan or second mortgage can be deducted from your taxes just like regular mortgage interest with the important limit of maximum. You can deduct mortgage interest on the first 750000 of the loan or. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Homeowners who are married but filing. Web The mortgage interest expense allows rental property owners to deduct any interest paid on a loan taken out to purchase build or improve a rental property from. Web If you got your mortgage after Oct.

Ad Shortening your term could save you money over the life of your loan. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage.

16 2017 the limit is 1 million 500000 if you and a spouse are filing separately. If you got a. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs.

You can deduct interest you paid on your mortgage throughout the tax year but only on the first 750000 of your loan or 375000 if youre. Filing your taxes just became easier. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

13 1987 and before Dec. Ad Use AARPs Mortgage Tax Calculator to See How Mortgage Payments Could Help Reduce Taxes. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad Over 90 million taxes filed with TaxAct. Web A mortgage calculator can help you determine how much interest you paid each month last year. Web Mortgage Interest.

Web IRS Publication 936. File your taxes stress-free online with TaxAct. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Coming Home To Tax Benefits Windermere Real Estate

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Effective Tax Rate Matters Evolved Tax Planning Southeast Mortgage

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Rules Limits For 2023

28 W9 Forms Free Download In 2020 Irs Forms Blank Form Inside Irs W9 Form 2021 Download Fillable Forms Calendar Template Blank Form

Mortgage Interest Deduction Save When Filing Your Taxes

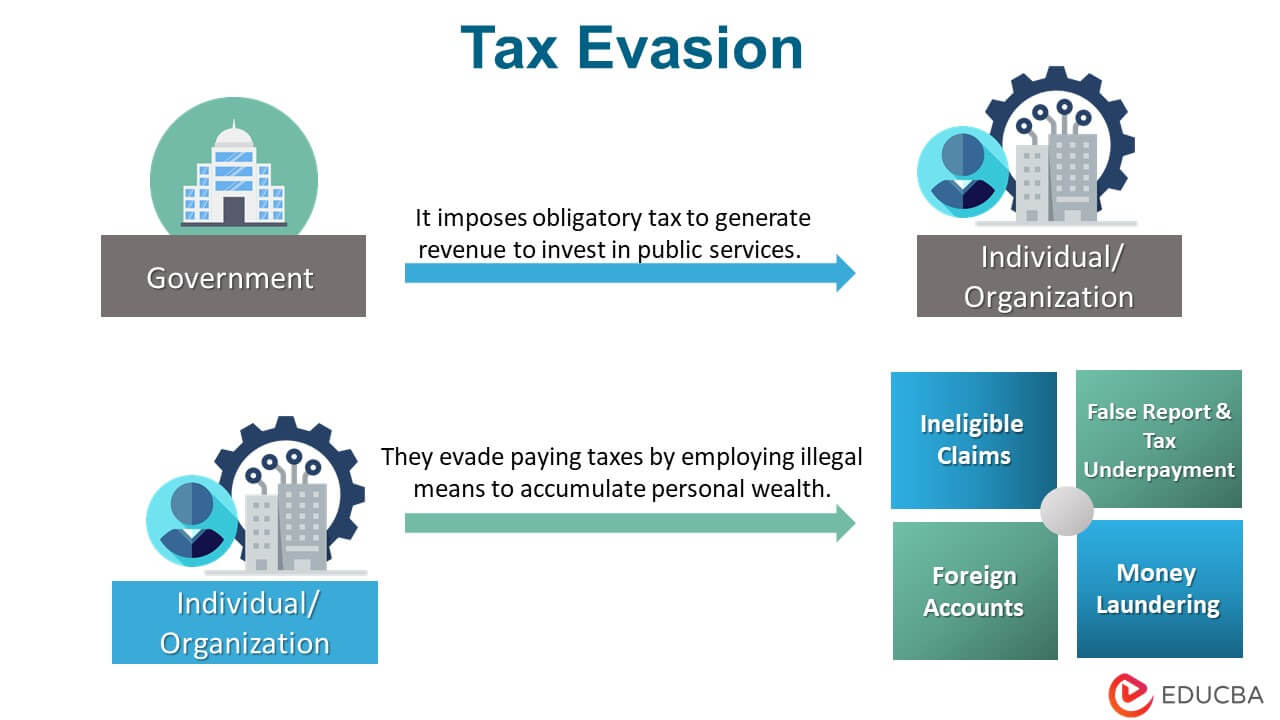

Tax Evasion Meaning Penalty Examples Cases

What Tax Breaks Do Homeowners Get In New York

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Spring Texas Property Taxes Real Estate Taxes Discover Spring Texas

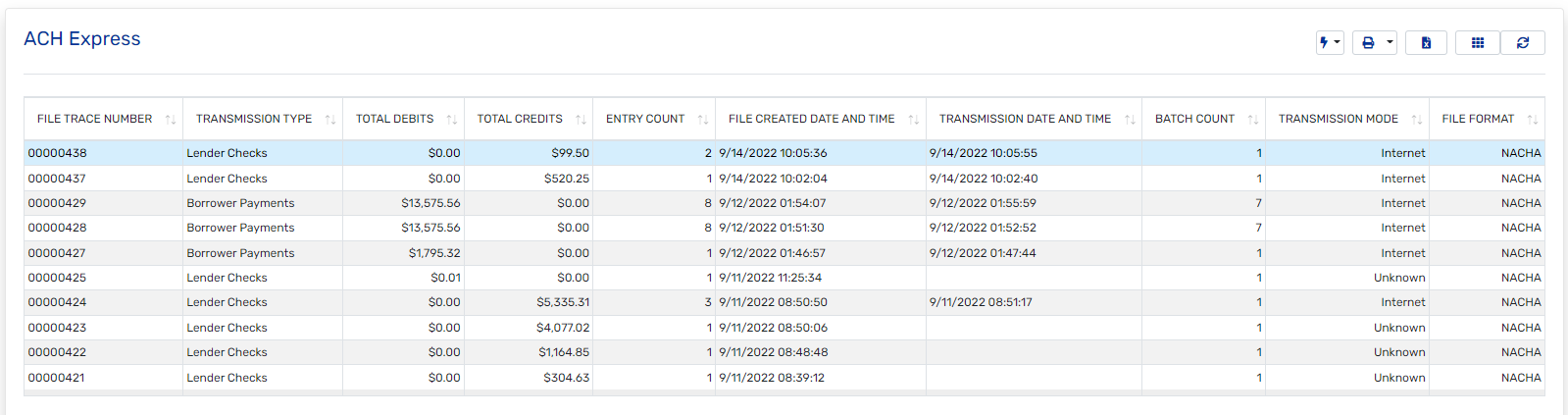

The Mortgage Office Software 2023 Reviews Pricing Demo

Progressive Tax Example And Graphs Of Progressive Tax

Loan Vs Mortgage Top 7 Best Differences With Infographics